EQRC historically started its activity in the area of Quantitative Analytics with an initial exclusive application into the area of quantitative finance / financial engineering. More specifically areas around Front Office problematics on both, the buy and sell side. This area has been our area of predilection and first love.

Today 90% of EQRC’s activity is still in quantitative finance more specifically around implied volatility surface modelling for various applications going from direct industry applications to education at the postgraduate level.

For confidentiality issues we are unable to share detailed materials on the projects we have been involved in but we do publish once in a while papers in areas we have academic expertise in and which we believe can be fully or partially applicable to problems in practical quantitative finance.

Please visit our download page for a more comprehensive content for the past projects we have been involved with.

The analogy behind the choice of the flying eagle in the picture on the left is twofold:

First the human view on the eagle’s position within the animal kingdom is usually one in which the adult bald eagle is an apex predator, therefore at the top of their food chain therefore determining the destiny of a whole ecological niche.

Second note the particular wings’ of our eagle which, span of shapes gives it, enormous dexterity and grace in determining its movement in the sky.

Vanilla options and more particularly the shape of the implied volatility surface has, since the arrival of the Black & Scholes formula determined the landscape of finance and the flexibility of shapes it can take, determines to the decimal point the pricing of complex derivative which pricing would become problematic without the added agility provided by this marvellous new mathematical tool.

“Beauty is the first test: there is no permanent place in the world for ugly mathematics.”

-G. H. Hardy

The very first task in any project is to formulate a problem. Although many times obvious, this task is many times superfluously taken care off.

Any quantitative solution is only correct within a tight set of assumptions. Their limits and consequences need to be understood as well as explained.

We take proud in design models which are enhancement of state of the art models well known and accepted but historically a tad overlay parsimonuous.

Efficient deployment of our client's preferred solutions is a critical point of our long term success and survival in the quant solution space.

Whether in investment banks, hedge funds or clearing houses, risk managing at the portfolio level has become an active area of research for practitioners in quantitative analytics. Within the framework of options risk modelling, it is essential to define a volatility surface that works with a variety of pricing models. As it happens, most pricing systems used in practice are designed in such a way that they cannot accommodate volatility surfaces that would allow for arbitrage opportunities. In clearing, one needs to make sure that the scenarios used in the IM calculations are coherent, and hence having a stressed volatility surface with arbitrages on it violates this constraint. In order to address this issue we need to create a methodology that would first, test whether a volatility surface is arbitrage free and second, adjust volatility surfaces that would prevent the presence of arbitrages. These steps have recently been introduced (download) and the methodology has been proposed to work in the equities, commodities, and FX markets. Although the gSVI parametrization introduced in the same paper happens to model the volatility surface geometrically in these specific markets, its de-arbitraging methodology is incomplete if applied to the FX market, specifically because of the “triangle rule” only relevant to the FX market. The objective of the IVP (download) is to complete this de-arbitraging methodology suggested, so that it works with the constraints induced by the triangle rule, as well as introducing an original liquidity model which enhances the parametrization as well as relaxing the de-arbitraging methodology a little.

Whether in investment banks, hedge funds or clearing houses, it is essential to define a volatility surface that works with a variety of pricing models.

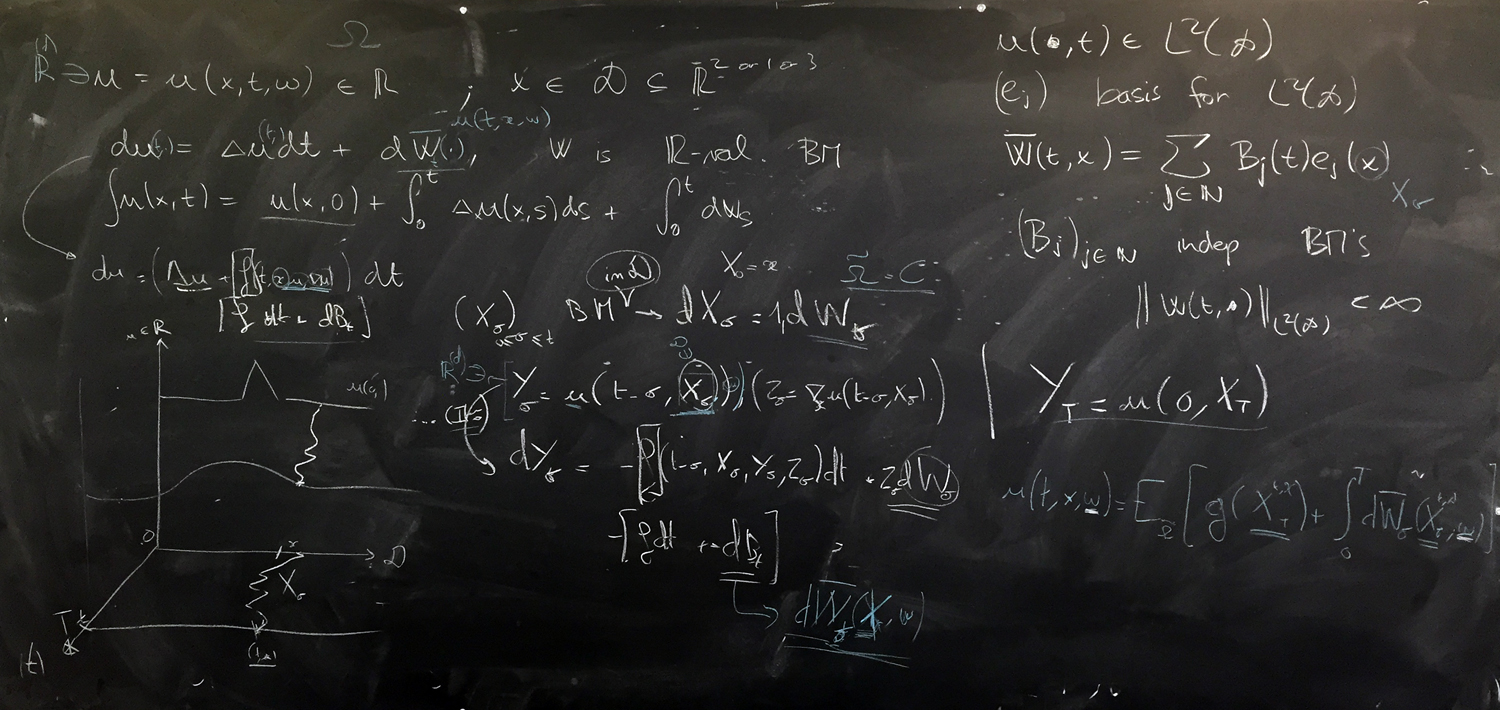

As it happens, most pricing systems used in practice are designed in such a way that they cannot accommodate volatility surfaces that would allow for arbitrage opportunities. Many issue around dimensionality and management of risk factors makes it sometimes difficult to handle a volatility surface with a grid alone. Added to that creating a diffusion around the risk factors of the implied volatility given its duality between observed mean reversion and arbitrage handling is still considered by many an open problem in Quantitative Finance. Our team has in the recent past taken leadership roles in the area of modelling the implied volatility surface give these constraints. Feel free to take a look at our last couple of publications around this topic.

“Introducing the Implied Volatility Surface Parametrization (IVP): Application to the FX Market”.

download

“the non misleading value of inferred correlation, an introduction to the cointelation model”.

download

“De-arbitraging With a Weak Smile: Application to Skew Risk”.

download